November Market Update

Commercial Real Estate Overview

- Federal Reserve Chair Jerome Powell signaled that the central bank is likely to slow the pace of rate increases to 50 bps in December after this week’s 75 bps hike, according to Goldman Sachs Research.

- The funds rate is likely to rise to a higher peak than policymakers had previously projected. Goldman economists expect the funds rate to top out at 4.75% to 5% next year, with some risk that the FOMC could raise rates higher than that.

- Uncertainty continues to rule the day and one thing investors dislike is uncertainty.

Trends

- Stock Buyback programs – Companies continue to look within, companies are on track to repurchase aproximately $1 trillion of U.S. stocks this year — the most in history, according to Neil Kearns, the head of the Corporate Trading Desk at Goldman.

- According to PWC, the days a home is on the market will likely continue to rise and there may be more negotiation over price — though average home prices are expected to stay high, at 30% more expensive than in 2019 and earlier.

- The continuation of remote work has impacts on the commercial real estate industry as well as the residential real estate side. For commercial, companies continuing to work remotely may give up their empty office spaces or downsize, leaving large swaths of commercial buildings empty for repurposing, also according to PWC.

Defeasance Market

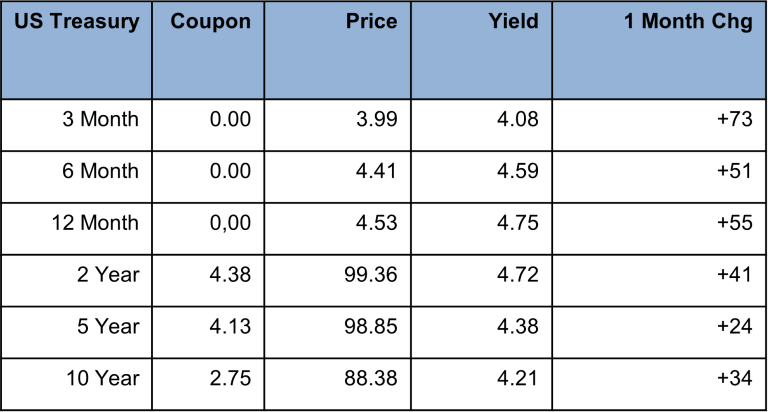

- The Yield Curve continues to be inverted with short rates higher than longer rates, the cost of defeasance continues to decline. There continues to be an appetite for deals getting done across most property types, this includes; Multifamily, Self-Storage, Mobile Home Communities, Industrial, Etc.. Because of rising rates the cost of defeasance is way down, even zero or negative in some cases, the challenge is for the borrowers to find palatable refinance terms on new loans or sales that are attractive.

- On the heels of a report that nearly a third of new CMBS issuance was afflicted with negative leverage in the third quarter comes the sobering realization of a potential reckoning to come: more than $17B of mortgage bonds back by office buildings come due in 2023.

Author