May 2024 Market Update

Economic Overview:

U.S. Federal Reserve Chair Jerome Powell has, once again, appeased investors. Following the latest Federal Open Market Committee meeting, Powell indicated that while interest-rate cuts may be delayed amid stubborn inflation, it is unlikely that the central bank’s next move is a rate hike. This, combined with a slowdown in the pace at which the Fed is shrinking its balance sheet, helped reassure investors that financial conditions aren’t likely to tighten further in the near future.U.S. economic activity expanded slightly from late February through April and firms signaled they expect inflation pressures to hold steady, a Federal Reserve survey showed on Wednesday, continuing recent trends that have kept the central bank from being able to cut interest rates. This according to Reuters.

Trends:

Based on data from CBRE, the U.S. commercial real estate lending market slowed in Q1 2024 due to high interest rates and limited credit availability, but a tightening of credit spreads indicated signs of stabilizing.

According to Cushman & Wakefield, The U.S. economy remains largely resilient in the face of higher rates; recession odds are the lowest they have been in two years.

Growth is expected to slow further, but the foundation remains solid for both households and businesses which will support CRE fundamentals and keep most assets cash flow positive, also according to C&W.

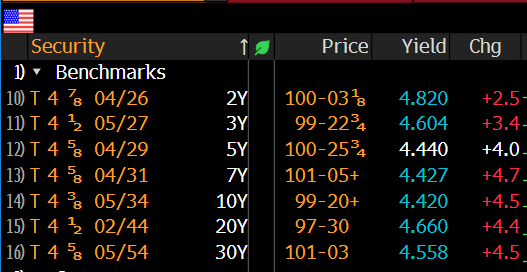

For real estate investors, one or two rate cuts in 2024 (though important in getting the yield curve on a path to un-inverting) wasn’t really going to move the needle this year. What is moving the needle is that buyers/sellers/lenders are finally getting conditioned to the higher cost of capital environment.

Defeasance Market:

- Much of the defeasance activity continues to be centered around asset sales as well as refinancing on notes with less than 2 years in duration, this is to be expected given higher rates and the inverted yield curve.

- The Lionshare of the asset classes being considered includes; Retail, Hospitality, NNN, Industrial as well as some smaller balance notes (i.e. less than 5 million).

Author