March 2024 Market Update

Economic Overview:

The resilience of the U.S. economy really has been remarkable when you consider how much consumer prices have gone up and how aggressively the Federal Reserve has raised interest rates, this according Capital Group U.S. economist Jared Franz.

Also, according to Franz – It is a testament to the American consumer and labor market durability, it has certainly helped alleviate some of the worries about an impending recession. That could still happen, although the risk has declined substantially.J.P. Morgan assumes the hiking cycle is over, leaving the Fed Funds on hold at 5.25%-5.5% until the middle of 2024. J.P. Morgan expects real GDP growth to walk the line between a slight expansion and contraction for much of this year, also known as a soft landing.

Trends:

Commercial real estate experienced a year of transition in 2023. Increased interest rates, inflationary pressures, and a recessionary cycle often made it difficult for purchasers and sellers to agree on terms.

The outlook for 2024 is improving, and many market participants remain optimistic, predicting increased deal flow by the second half of the year. Interest rates seem to have normalized, or industry insiders are accepting that rates will be “higher for longer.” Investors that have been sitting on the sidelines appear to be ready to deploy capital and re-enter the market. This is according to Reuters.

Defeasance Market:

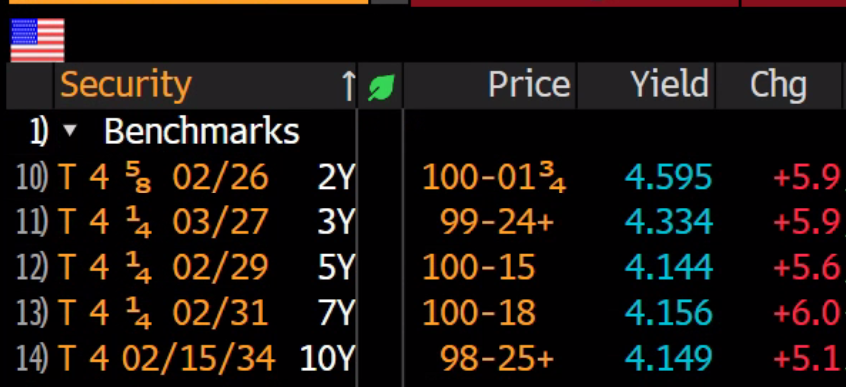

- The cost of defeasance continues to trade within a relatively tight range based on the duration and rate of the underlying note, this is because of higher rates and the inverted yield curve.

- At this point in the market cycle, the focus on defeasance transactions continues to be in asset sales as well as refinances with less term remaining, typically notes with less than 2 years remaining.

- The Lionshare of the asset classes being considered includes; Self-Storage, Retail, Multifamily and NNN.

Author