February Market Update

The runway is looking like its clearing up for the Federal Reserve Bank to execute on their first ever soft landing. However the economic storms and its indicators may come into play as the Fed continues to check its instruments.

Economic Overview:

The start of 2023 has seen the continued spillover of volatility from 2022, equity prices continue to try and fight back while uncertainty is the rule rather than the exception. Interest rates rose at the fastest pace in decades and commodity prices have gyrated in response to high inflation and geopolitical tensions.

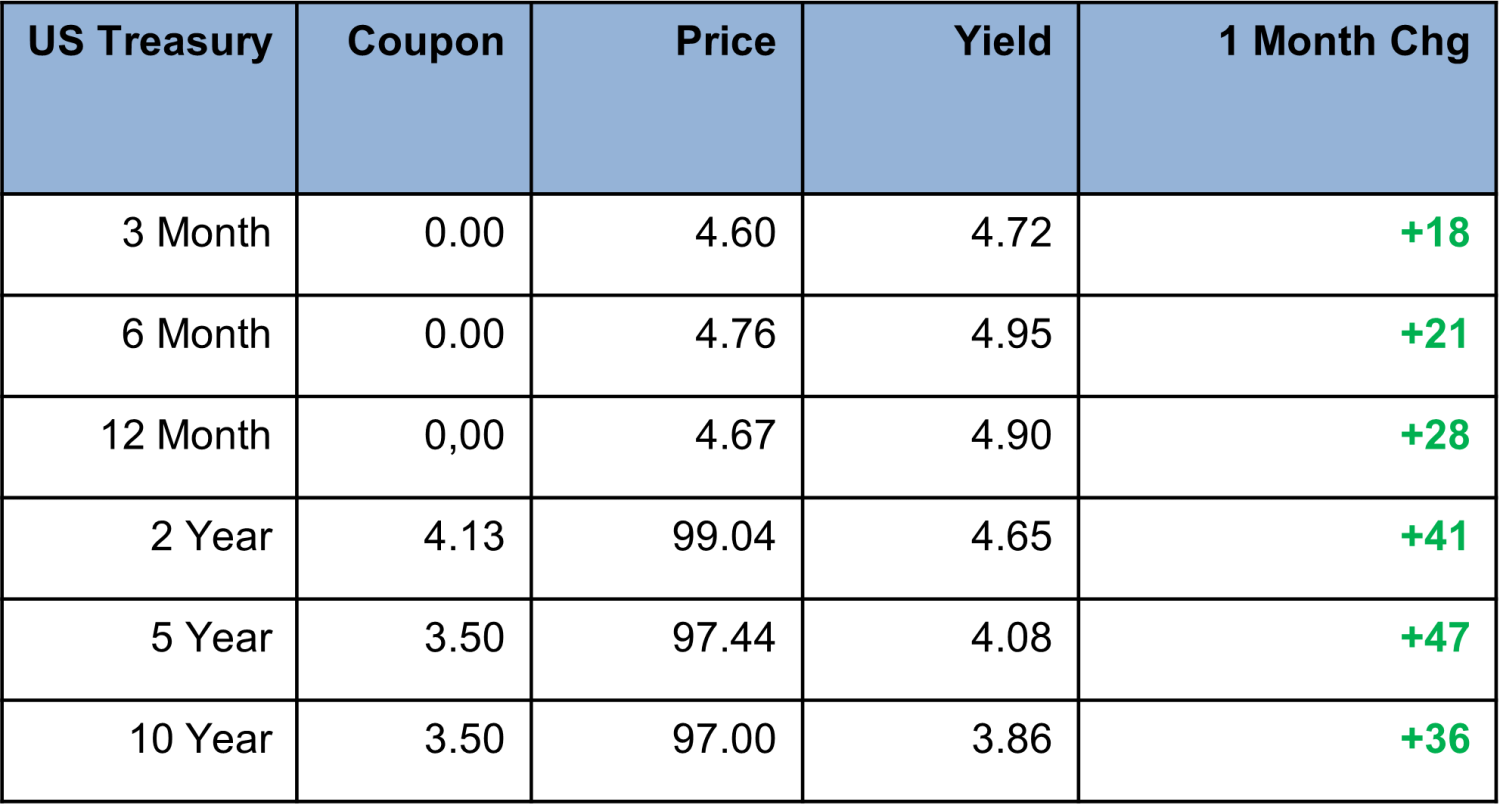

As the Federal Reserve continues to slow interest rate increases, increasing rates at a decreasing rate, according to Goldman Sachs inflation appears to have peaked last summer in June of 2022. The market uncertainty and “push pull” nature is evident by the inverted yield curve, in which the spread between the 10 year and 2-year Treasury Yield is minus 82.5 basis points, the largest spread in 41 years.

Trends:

Despite economic uncertainty and growing interest rates, the U.S. commercial real estate market experienced successes in 2022, for example Atlanta saw $30.7 billion in direct investment in commercial real estate during 2022. This is as much as Beijing, Tokyo and Singapore combined, according to JLL.

It also should be noted, according to Forbes, the commercial real estate landscape has changed a bit in the past few months. As a result of higher borrowing costs and a wider bid-ask spread, a lot of commercial real estate investment activity seems to have slowed. This is leaving many institutional investors, who have raised money over the past few years, on the sidelines. But the fundamentals around the strongest-performing asset classes haven’t changed (e.g., the housing shortage still persists, which provides a strong tailwind for residential), institutions seem to be simply waiting for the right moment.

Defeasance Market:

As we have been reporting, much of the defeasance market continues to be driven by the inverted Yield Curve, the cost of defeasance is still the lowest it has been in years. There are a steady number of transactions getting done across many property types, including; Multifamily, Self-Storage, Retail, Industrial, Etc.. The sweet spot for exiting CMBS and Freddie notes is: 1. refinance to take equity out 2. Refinance to lock in longer term rates 3. Sales.

Author