April 2024 Market Update

Economic Overview:

U.S. consumer prices increased more than expected in March as Americans continued to pay more for gasoline and rental housing, leading financial markets to anticipate that the Federal Reserve would delay cutting interest rates until September.

The third straight month of strong consumer price readings reported by the Labor Department on Wednesday also suggested that the pickup in inflation in January and February could not be solely attributed to businesses raising prices at the start of the year as economists had argued. This according to Reuters.

Economists at Goldman Sachs Group Inc. are forecasting two Federal Reserve interest-rate cuts this year instead of three after Wednesday’s report showing consumer prices rose more than estimated in March.

Trends:

According to CBRE research compelling opportunities should emerge for commercial real estate investors in 2024, as high interest rates and an economic slowdown, perhaps even a mild recession, lead to bargain pricing for certain assets.

Secondary office assets have already seen sharply lower pricing due to rising vacancies, as hybrid working arrangements now appear permanent. Eventually as interest rates begin to fall and inflation eases, rehabilitation or conversion of underperforming office buildings to other uses will become more attractive and financially viable. This process will receive substantially more state and local government aid in the second half of 2024.

Defeasance Market:

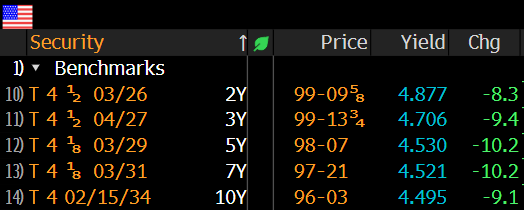

Much of the defeasance activity is centered around asset sales as well as refinancing on notes with less than 2 years in duration, this is to be expected given higher rates and the inverted yield curve.

The 2-year treasury has moved up approximately 70 bips in the past 90 days.

The Lionshare of the asset classes being considered includes: Self-Storage, Retail, Multifamily, Mobile Home Communities and NNN.

Author