January 2026 Market Update

Economic Climate:

- U.S. economic growth remains moderate but positive, with forecasts suggesting real GDP expansion around or above trend in 2026 (e.g., around ~2.2–2.6% for the full year according to some forecasts). Strong recent growth in late 2025 (e.g., robust Q3 and Q4 figures) may carry momentum into early 2026, though this may not persist throughout the year.

- Hiring remains sluggish compared to previous years, with smaller job gains and a notable slowdown in job creation. Unemployment has stayed relatively low (around mid-4% range), but some measures point to weakening labor demand. Surveys and sentiment indicators reflect softening labor market conditions and consumer concerns about job prospects.

- Consumer sentiment slightly improved in January 2026, rising for the second month in a row, but it is still well below year-ago levels due to high costs and labor market concerns. Household confidence remains depressed relative to 2025, with ongoing worries about inflation and economic conditions. Consumer spending remains a key driver of growth, supported by wage gains and relatively low layoffs, though purchasing power is stretched.

- Inflation remains above the Federal Reserve’s 2% target, with core measures still elevated (e.g., around ~2.8% late 2025). Price pressures — including input costs from tariffs — continue to be a factor for businesses.

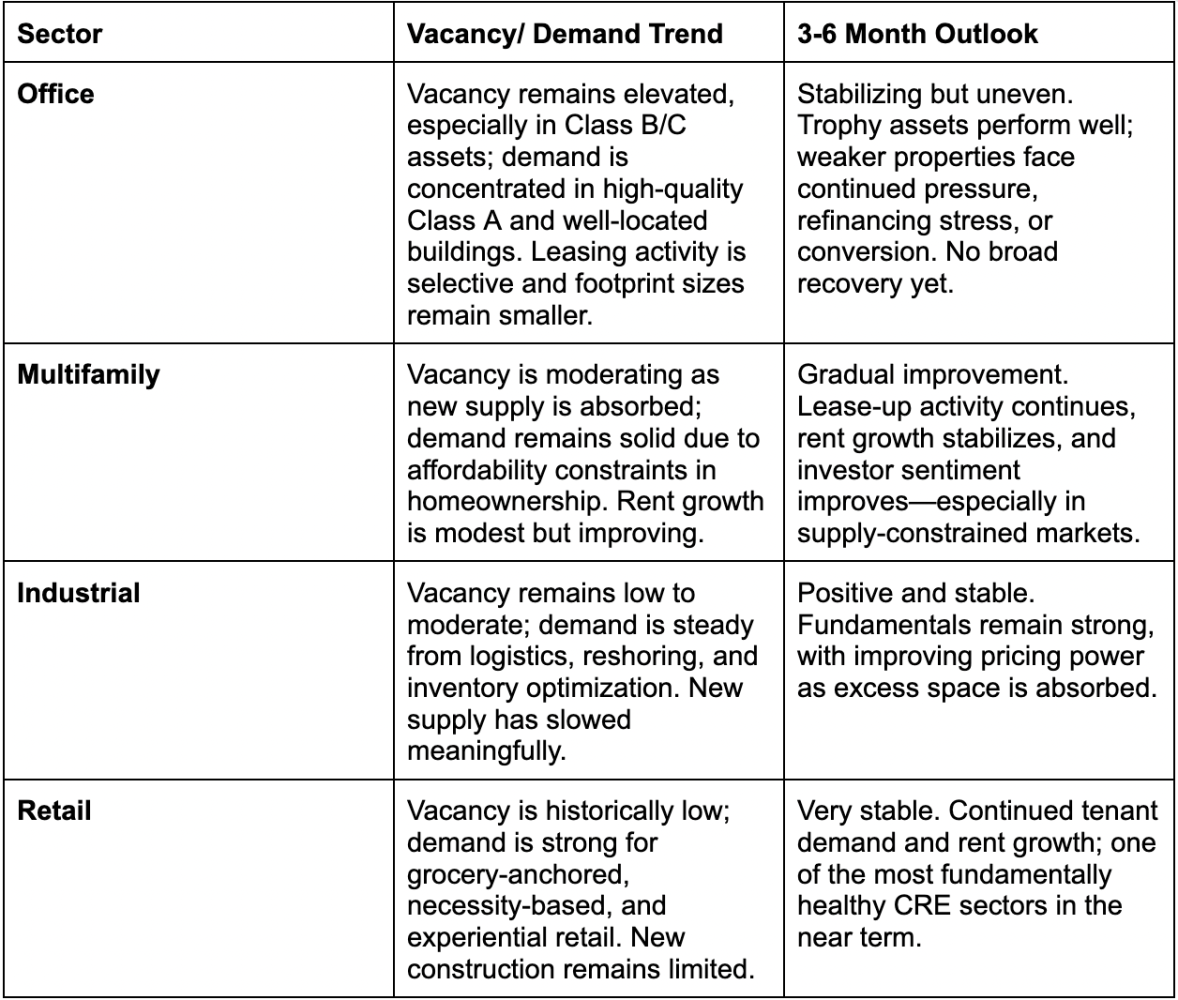

Commercial Real Estate outlook:

- Many CRE professionals are increasingly optimistic about 2026, with surveys showing rising confidence and expected activity growth.

- Investment activity is projected to grow meaningfully (e.g., ~16% increase in total CRE investment to near pre-pandemic levels).

- Capital markets are improving, with more debt availability and pricing normalization, attracting institutional and cross-border investors.

- CRE transaction volumes and sales activity are expected to rise ~15-20% in 2026.

Defeasance update:

- Activity expected to increase modestly vs. 2025

Defeasance volume should rise as more borrowers refinance or sell assets ahead of loan maturities, especially where rates ease or spreads tighten. - CMBS maturity wall is the main driver

A large cohort of 2016–2019 vintage CMBS loans moves closer to maturity, increasing prepay and defeasance events—particularly in retail, industrial, and multifamily. - Interest rate environment remains supportive, not explosive

Even modest rate cuts or curve stabilization make defeasance more economical than in prior years, but higher-for-longer rates still cap upside. - Treasury volatility creates timing sensitivity

Borrowers are increasingly opportunistic—executing defeasance during short windows of favorable Treasury movements rather than on fixed timelines. - Increased borrower education and early engagement

More borrowers are modeling defeasance costs earlier in the process, improving execution certainty and deal flow for servicers and advisors. - Servicer pipelines and processing volume grow

Special servicers and defeasance consultants should see steadier, more consistent workflows versus the choppy conditions of 2023–2024. - Overall, 2026 is shaping up as a constructive but disciplined year for defeasance—not a boom, but a clear step up from recent lows, driven by CMBS maturities, selective asset sales, and gradual normalization in rates.

Author