December 2025 Market Update

Defeasance 2025 Year in Review:

· Defeasance activity in 2025 occurred against a stressed CMBS backdrop, with overall delinquency rates remaining elevated above 7% for much of the year, limiting opportunistic loan payoffs and refinancing-driven defeasance.

· Office and multifamily sectors exhibited heightened distress, with office delinquencies reaching record levels and multifamily delinquency rising to the highest levels seen in nearly a decade, constraining defeasance viability for weaker assets.

· A significant CMBS maturity wall shaped borrower decision-making, as more than $150 billion of private-label CMBS loans were scheduled to mature in 2025, forcing sponsors to evaluate payoff, extension, restructuring, or defeasance alternatives.

· Capital markets liquidity remained available through ongoing CMBS issuance, providing refinancing options for higher-quality assets and reducing the need for defeasance in some transactions.

· Defeasance activity skewed toward necessity rather than opportunity, with execution primarily tied to asset sales, mandatory release provisions, or strategic restructurings rather than rate-driven refinancing.

· Overall, 2025 defeasance volumes remained subdued, shaped more by credit stress, maturity pressure, and market selectivity than by favorable interest-rate economics.

Defeasance Outlook — 2026 (vs. 2025)

· Defeasance activity is expected to recover modestly in 2026, with total volumes projected to increase ~10–20% versus 2025, as interest rates gradually ease and market volatility declines.

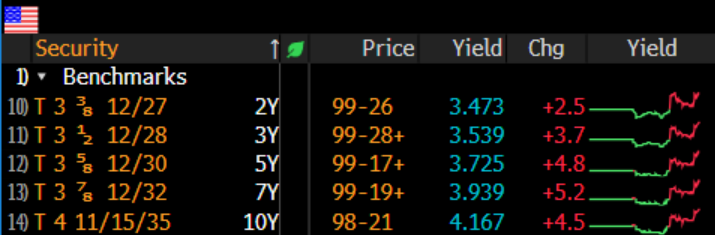

· Defeasance economics should improve meaningfully relative to 2025, with lower Treasury yields reducing replacement collateral costs by an estimated 5–15%, bringing more loans back into feasibility.

· Refinancing-driven defeasance is likely to re-emerge, reversing part of the 2025 dynamic in which ~60%+ of activity was transaction-driven, and shifting the mix closer to a balanced refi vs. sale split.

· Loan vintages from 2016–2018 will be a primary driver, as maturing CMBS loans with above-market coupons face refinancing pressure and sponsor incentives to reset capital stacks.

· Multifamily and industrial are expected to increase their share further, potentially accounting for ~65%+ of defeasance volume, while office activity remains selective and concentrated in high-quality assets.

· Execution cadence should become more consistent than in 2025, with fewer start-stop windows and a longer planning horizon as borrowers move from monitoring to execution.

Summary of Overall Expectations in 2026:

Looking ahead, the defeasance market is poised for modest improvement as financing conditions gradually normalize. With a sizable pipeline of CMBS maturities carrying over into 2026 and continued issuance supporting market liquidity, borrowers may find more viable refinance and payoff windows if interest rates soften relative to 2025 levels. Improvements in Treasury yields and reduced volatility could lower replacement collateral costs and expand economic opportunities for defeasance, particularly for multifamily and industrial assets with stable cash flows. However, persistent stress in certain property sectors—especially office—and ongoing maturity drag could continue to temper broad-based acceleration, keeping 2026 defeasance growth measured and selective rather than cyclical.

Author