October 2025 Market Update

Economic Climate:

Moderate U.S. growth (~1.8 – 2.0%) — The economy is slowing but not contracting; consumer spending and services remain resilient while manufacturing and exports face headwinds.

Inflation slightly sticky (~3%) — Price pressures have eased but not fully normalized; the Fed remains cautious, likely delaying aggressive rate cuts until inflation moves closer to 2%.

Labor market cooling — Job gains are slowing and wage growth is moderating, signaling softer momentum heading into late 2025.

Potential Fed cut (end of October) — The Fed meets at the end of October and there’s a good chance that there will be another Fed cut. Most likely another 25 bps, with more cuts projected over the next 6-9 months.

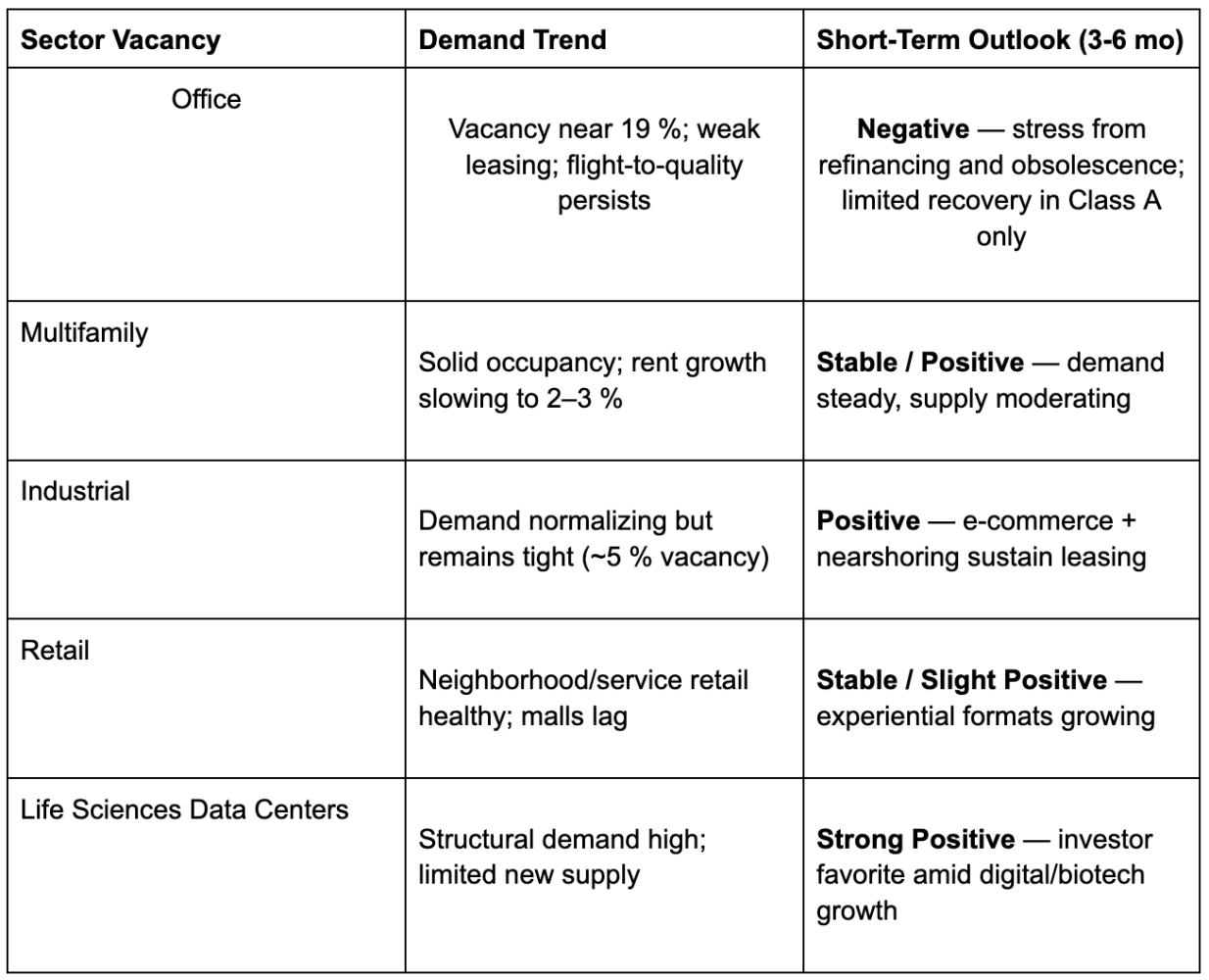

Commercial Real Estate outlook:

As of October 2025, the U.S. commercial real estate market remains divided between resilient and distressed sectors. Office properties continue to struggle with record-high vacancies near 19%, declining valuations, and refinancing pressure, though top-tier Class A assets in prime markets show some stabilization. In contrast, industrial, multifamily, and alternative sectors—notably data centers and life sciences—are maintaining solid fundamentals supported by steady demand and limited new supply. Retail and hospitality are performing moderately well, buoyed by consumer spending and travel recovery, while older malls and lower-tier offices face obsolescence. High interest rates and tighter lending conditions remain key headwinds, but investors are selectively deploying capital toward quality, income-stable assets in growth markets, with opportunities emerging in distressed and repositioned properties.

Defeasance update:

With a large “maturity wall” approaching (over $1+ trillion of CRE debt coming due through 2026) the push to resolve maturing loans is becoming urgent.

The volume of defeasance (and related debt‐exit transactions) should pick up through late 2025 and 2026 — but the gains will be uneven. Prime assets in growth markets will see better access; marginal assets will face higher cost refinancing or limited options.

Key risk factors to monitor: if long-term Treasury yields or swap spreads move higher (or fail to come down), the cost of defeasance will increase and refinancing windows will narrow; conversely, if the rate cut cycle accelerates and property values stabilize, defeasance will become relatively more attractive. Borrower and lender discipline (in terms of asset quality, underwriting) will matter a lot.

In short: expect rising defeasance activity, but uneven by sector and asset quality, driven by the debt-maturity schedule, interest-rate path, and property fundamentals.

Author