September 2025 Market Update

Economic Climate:

Growth Cooling – GDP growth is projected around 1.6% for 2025, with Q3 still solid but a slowdown expected into late 2025.

Inflation Moderating but Sticky – Core PCE inflation is easing, though it remains above the Fed’s 2% target, with risks from tariffs and supply pressures.

Labor Market Softening – Unemployment is edging higher (~4.5% expected), with weaker job openings and shorter work hours signaling cooling demand.

Fed’s First Rate Cut – The Federal Reserve delivered its first rate cut of 2025 this week (25 bps), signaling caution on growth but keeping policy relatively restrictive to avoid reigniting inflation.

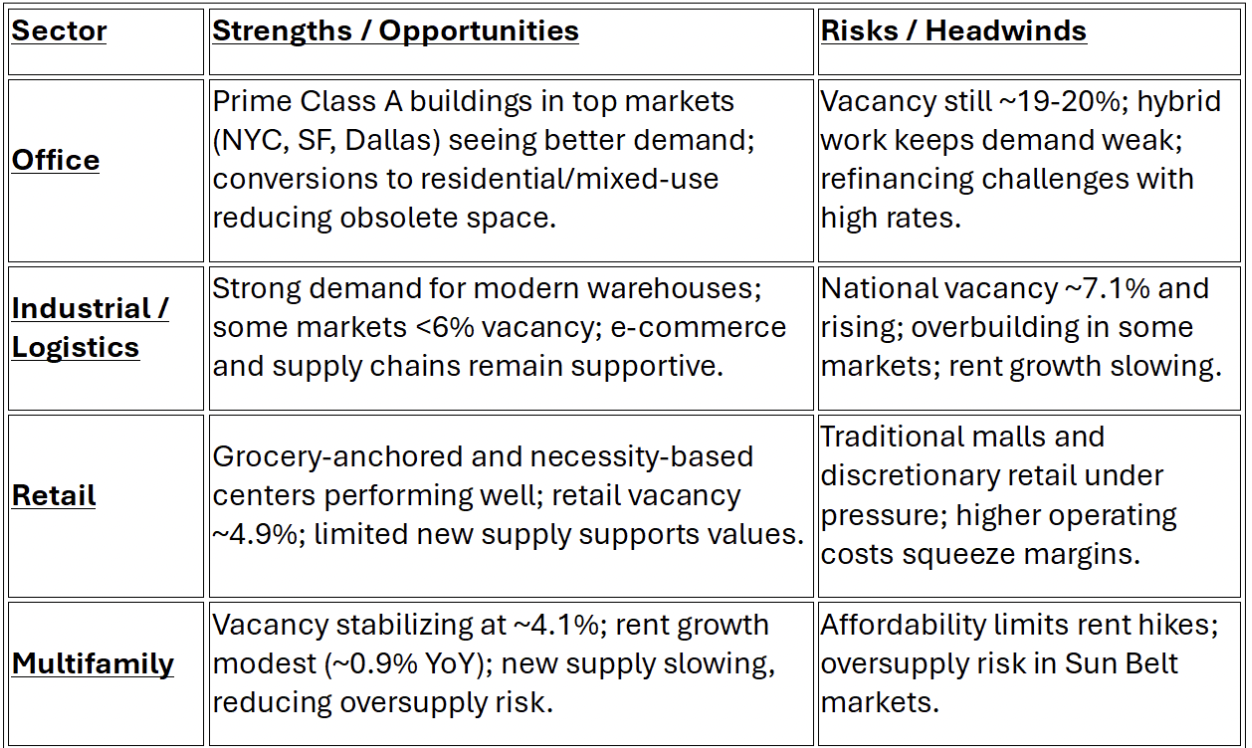

Commercial Real Estate outlook:

Commercial real estate will remain challenged through year-end 2025, with office vacancies near record highs (~19.4% nationally) and industrial vacancies climbing (~7.1%, highest in a decade), while multifamily (~4.1% vacancy) and retail (~4.9%) show more stability. The Fed’s September 2025 rate cut provides some relief for refinancing costs and transaction activity, but borrowing conditions remain tight, meaning only top-tier, necessity-driven assets are likely to benefit meaningfully in the near term.

Defeasance update:

Defeasance volume has picked up compared to summer lows as some borrowers take advantage of rate stability and marginally lower financing costs. However, overall activity remains well below pre-2022 levels due to lingering rate volatility and refinancing uncertainty.

The recent Fed cut will provide incremental relief for borrowers, making defeasance more feasible for some loans that were uneconomic at higher Treasury rates. Expect a short-term uptick in activity, particularly for borrowers with industrial, multifamily, and retail collateral where valuations are stronger.

Pipeline into 2026 – The backlog of CRE maturities means defeasance demand will stay elevated, but execution will remain highly rate-sensitive. If the Fed signals further cuts, the market could see a more meaningful pickup in Q4 and early 2026.

Author